The US tax system is considered one of the most developed tax systems. The USA is a country-oriented towards a liberal economic model and is a federal state. It uses a three-tier tax system:

- federal taxes,

- state taxes,

- local taxes.

The body that administers taxes in the United States is the Internal Revenue Service (IRS), the largest division of the US Treasury Department.

There are so many subtleties in filing taxes (the average man in the street rarely encounters them, but it happens) that you cannot simply limit yourself to a website: there is a special profession “tax consultant” who understand all the points and subtleties of thousands and thousands of rules and special cases.

The specificity of the composition and structure of the US tax system is determined by the scale of the use of all types of direct taxation. In the US taxation system, the main types of taxes are used in parallel at all levels of government. So, the population pays 3 income taxes, 3 corporate income taxes, 2 property taxes, etc.

The main part of federal budget revenues is income tax, the subjects of which are individuals, individual enterprises, and partnerships that do not have the status of a legal entity.

The counting is done in 3 steps:

1. The gross income is calculated, which may consist of:

- wages,

- pension,

- alimony,

- securities income,

- benefits,

- bonuses,

- annuities and royalties,

- farm income,

- social security,

- unemployment benefits,

- scholarships,

- income from trusts and real estate, etc.

2. Gross income is adjusted by deducting eligible costs and benefits from it. These include:

- trading or operating costs,

- losses from the sale or exchange of securities,

- pension contributions from persons,

- an alimony payment,

- advance tax contributions, etc.

3. The classified or standard deductions are excluded from the adjusted gross income. The resulting amount is taxable income. The main deductions include:

- a non-taxable minimum for each dependent of the taxpayer;

- standard discounts, additional discounts for people over 65 and disabled people;

- expenses for moving to a new place of a residence related to professional development;

- travel contributions;

- charitable contributions, etc.

These deductions can be made up to 50% of the adjusted gross income, and the remaining 25% can be deducted from income within 5 years.

Another major tax in the income tax system is the corporate income tax, which has undergone significant changes as a result of the well-known tax reforms of the 1980s and 1990s.

The main principle of corporate taxation in the United States is the taxation of net income as the final object of taxation. The payers of this tax are primarily joint-stock companies. Approximately 85% of the tax is levied at the federal level, and 15% by states and local governments.

The taxable object is determined in 3 stages:

1. Determined the gross income of the company, consisting of gross sales proceeds and all non-operating income and expenses.

2. Subtracted from gross income are:

- employee wages,

- repair costs,

- bad debts,

- rent payments,

- paid local and state taxes,

- depreciation,

- interest on loans,

- advertising costs,

- pension contributions,

- natural disaster losses,

- charitable contributions,

- operating losses,

- capital repair costs, etc.

Tax legislation carefully specifies all costs that can be included in production costs when determining the corporation tax. The international standards underlying these laws are fairly liberal.

As a rule, the individual list is allowed to include all the costs of the company associated with its current production and commercial activities.

The restrictions are insignificant and mainly relate to the prohibition on the inclusion of “excessive” entertainment expenses in the costs.

3. After deducting costs, additional costs, and taxes paid from gross income, those benefits are deducted from it that are directly aimed at reducing taxable profit. The final stage is associated with solving the problem of double taxation of that part of the profit that is directed to the payment of dividends.

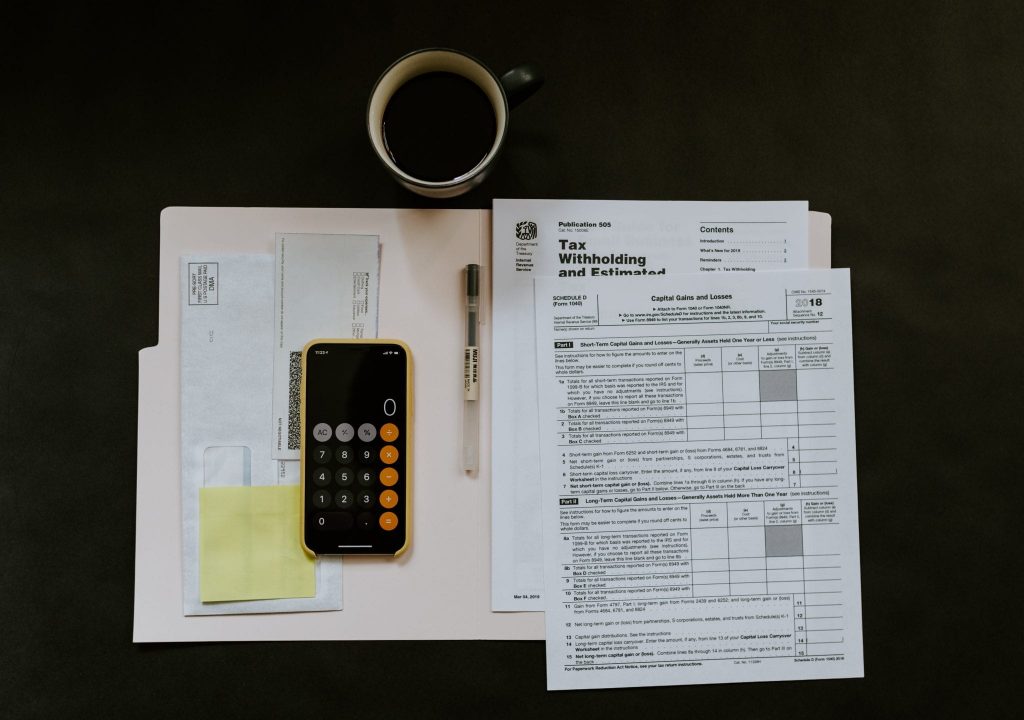

Picture Credit: Unsplash